The foreign exchange market, which is usually known as “forex” or “FX” is the largest financial market in the world. In this market a trader can trade in CURRENCIES PAIRS (EURUSD, GBPUSD, GBPJPY, etc..), COMMODITIES (Gold, Silver, Platinum, Energies etc..), INDICES (Dax, Dow, NASDAQ, UK100, FTSE etc..) and CRYPTOCURRENCIES independently by using of a trading account with anyone of the regulating forex broker.

| CODE | COUNTRY | CURRENCY | NICKNAME |

|---|---|---|---|

| USD | United States | Dollar | Buck |

| EUR | Eurozone | Euro | Fiber |

| JPY | Japan | Yen | Yen |

| GBP | Great Britain | Pound | Cable |

| CHF | Switzerland | Franc | Swissy |

| CAD | Canada | Dollar | Loonie |

| AUD | Australia | Dollar | Aussie |

| NZD | New Zealand | Dollar | Kiwi |

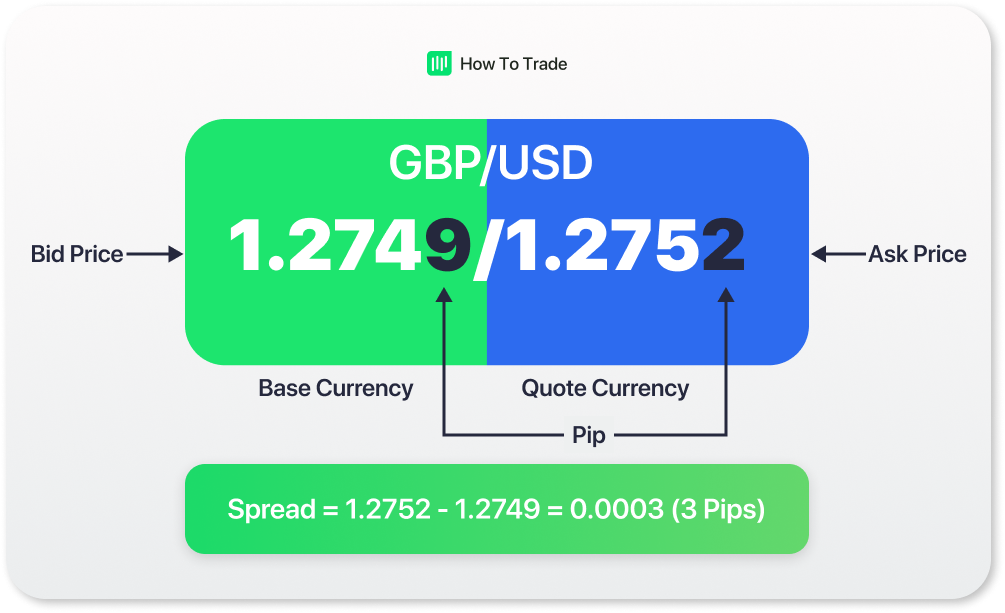

A pip is usually the last decimal place of a price quote. If GBPUSD moves from 1.1049 to 1.1050, that .0001 USD rise in value is ONE PIP. A pip is a measurement of movement in forex trading, used to define the change in value between two currencies.

A “lot” is a unit measuring a transaction amount. Basically the number of currency units you will buy or sell.

It is true that the forex market is open 24 hours a day, but that doesn’t mean it’s always active the entire day. The forex market can be broken up into four major trading sessions:

- The Sydney session

- The Tokyo session

- The London session

- The New York session.

- Technical Analysis

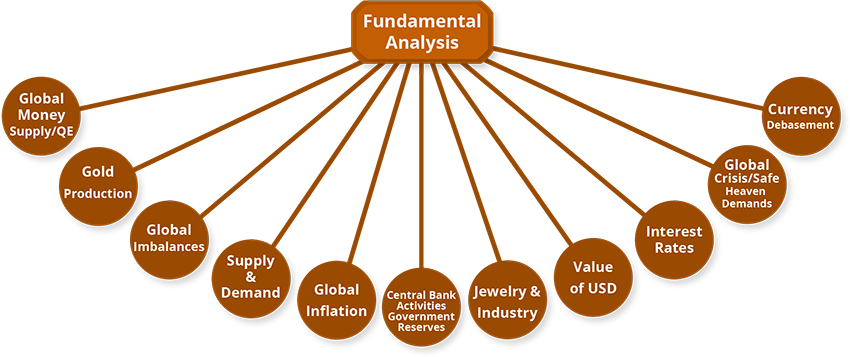

- Fundamental Analysis

- Sentiment Analysis

When the price moves up and then pulls back, the highest point reached before it pulled back is now resistance.

Resistance levels indicate where there will be a surplus of sellers.

When the price continues up again, the lowest point reached before it started back is now support.

Support levels indicate where there will be a surplus of buyers.